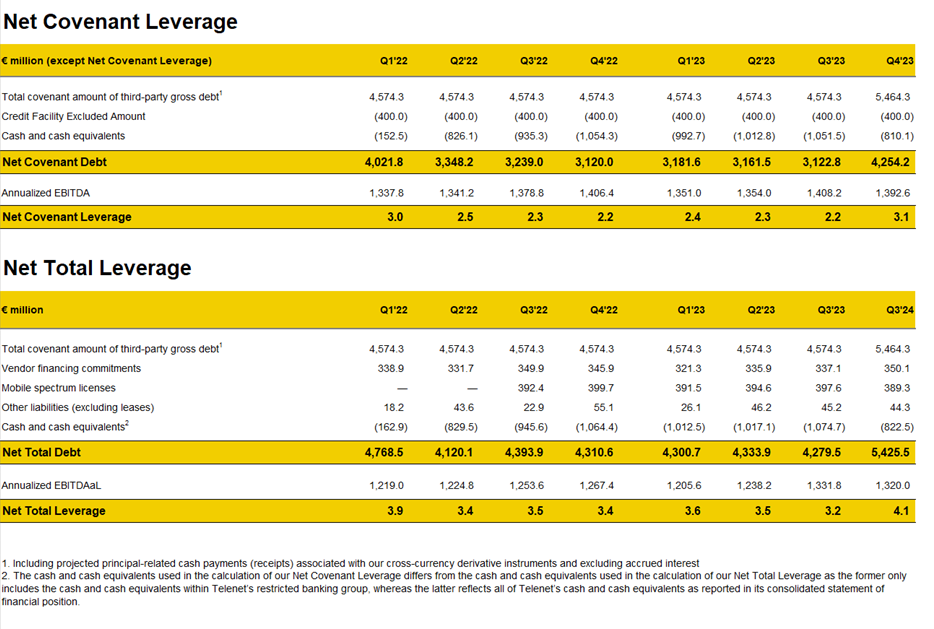

Net leverage ratio

At December 31, 2023, and subject to the completion of our corresponding compliance reporting requirements, the ratios of Net Total Leverage and Net Covenant Leverage were 4.1x and 3.1x compared to 3.2x and 2.2x at September 30, 2023. The increase in leverage is consistent with Liberty Global’s intention to align Telenet’s capital structure with Liberty Global’s 4-5x Adjusted EBITDAaL.

For additional information, we refer to our Q4 2023 earnings release.